Q4 2024 Suburban Maryland Market Report

For additional statistics, download the full report

Market Overview

The Suburban Maryland office market remained under considerable pressure throughout 2024. In the fourth quarter, the market recorded negative net absorption of 794,592 square feet, bringing the total for 2024 to negative 1.35 million square feet. This follows negative 945,888 square feet of absorption recorded in 2023, driven by a lack of organic tenant demand and entrenched hybrid work policies that continue to hamper the leasing market and occupancy rates. Educational technology firm 2U contributed significantly to this negative absorption, vacating nearly 300,000 square feet at 7900 Harkins Road in Lanham and relocating to a significantly smaller footprint in Crystal City, VA.

Overall rental rates across the market increased slightly to $32.70/SF, representing a 0.43% increase year-over-year. Rental rates in Class B buildings average $27.54/SF, offering a more cost-effective alternative for tenants seeking value without sacrificing location or functionality. As a possible indicator of the type of tenant demand in Suburban Maryland, Class B properties have fared better from an occupancy standpoint, with the asset type’s vacancy rate at 20.6%, performing ~3% better compared to the broader market.

Leasing activity in the fourth quarter was anchored by several notable transactions, including Montgomery County’s renewal of 104,000 square feet at 1401 Rockville Pike in the Rockville submarket, Eagle Bancorp’s 65,997-square-foot new lease at 7500 Old Georgetown Road in Bethesda, and AECOM’s sublease of 34,421 square feet at 5700 Rivertech Court in College Park. These deals illustrate tenant preferences for well-located properties within core submarkets, though overall leasing velocity remains subdued. In the sales market, Suburban Maryland saw limited investment activity during the fourth quarter, reflecting heightened caution among investors navigating rising interest rates and shifting property valuations.

Quarterly Key Performance Indicators

- Net Absorption: 794,592 SF

- Direct Asking Rent: $32.70/SF

- Vacancy: 22.94%

Notable Regional Insights

- Educational technology firm 2U vacated nearly 300,000 SF in Lanham, relocating to a significantly smaller footprint in Crystal City, VA.

- As part of the ongoing trend of federal agencies reducing their office footprints, the FDA vacated 113,732 SF in Rockville and the Department of Energy vacated 96,973 SF in Germantown.

Market Data

Occupancy Trends

The Suburban Maryland office market saw two notable deliveries in 2024, both situated in Montgomery County. In February, the Germantown submarket welcomed a new Class A office building at 20521 Seneca Meadows Parkway, encompassing 73,166 square feet. The building is currently 78.1% leased, with BlueHalo signing a lease in August for 57,000 square feet. Additionally, the North Silver Spring/Rt 29 submarket added a fully leased 40,000-square-foot Class B building at 12255 Prosperity Drive, with Arthritis & Rheumatism Associates signing a lease for 20,000 square feet in November. In the fourth quarter of 2024, the market faced significant challenges, recording negative net absorption of 794,592 square feet. The decline was driven by significant move-outs, including 2U vacating nearly 300,000 square feet at 7900 Harkins Road, along with over 100,000 square feet of negative absorption in Class A buildings in Silver Spring and Germantown. Year-to-date net absorption has dropped to negative 1,354,011 square feet, highlighting the ongoing challenges in tenant demand across the market.

Construction Snapshot

Following nearly a decade of active development, the Suburban Maryland office market’s pipeline has sharply leveled off due to unpredictable tenant demand, rising construction costs, and broader economic challenges. Despite the flight-to-quality trend, even trophy properties have struggled to attract tenants, particularly along Wisconsin Avenue in Bethesda. Of Suburban Maryland’s three trophy buildings, two are located on Wisconsin Avenue and have faced significant leasing challenges. Delivered in 2022, 7373 Wisconsin Avenue is just 44.6% leased, while 7272 Wisconsin Avenue, completed in 2021, is 66.7% leased. Meanwhile, 4747 Bethesda Avenue, built in 2019, stands fully leased—illustrating how timing and market conditions can significantly impact performance, even for top-tier properties.

Market Vacancy

The Suburban Maryland office market is seeing a clear divide in performance between Class A and Class B properties. As of 2024, Class B buildings maintain a lower average vacancy rate of 20.0%, while Class A properties are struggling with significantly higher vacancies at 23.8%. This disparity has been amplified by recent spaces put on the market in key submarkets like Germantown and Bethesda/Chevy Chase, which have added substantial un-leased inventory to the market. A prime example is the 183,210-square-foot Class A office building at 12410 Milestone Center Drive, which added two spaces to the market in the third quarter of 2024, all 48,097 square feet of which remains 100% vacant. On the other hand, the Bethesda/Chevy Chase submarket added 25 fully vacant spaces between 12 different buildings, totaling 71,904 square feet. Class A buildings make up 77.4%, or 55,677 square feet, of the newly added vacant space in Bethesda/Chevy Chase in the third quarter of 2024. These new additions are contributing significantly to the elevated vacancy rates in Class A spaces, as landlords face the challenge of leasing premium office space in a market where tenant demand remains uncertain.

Sublease Report

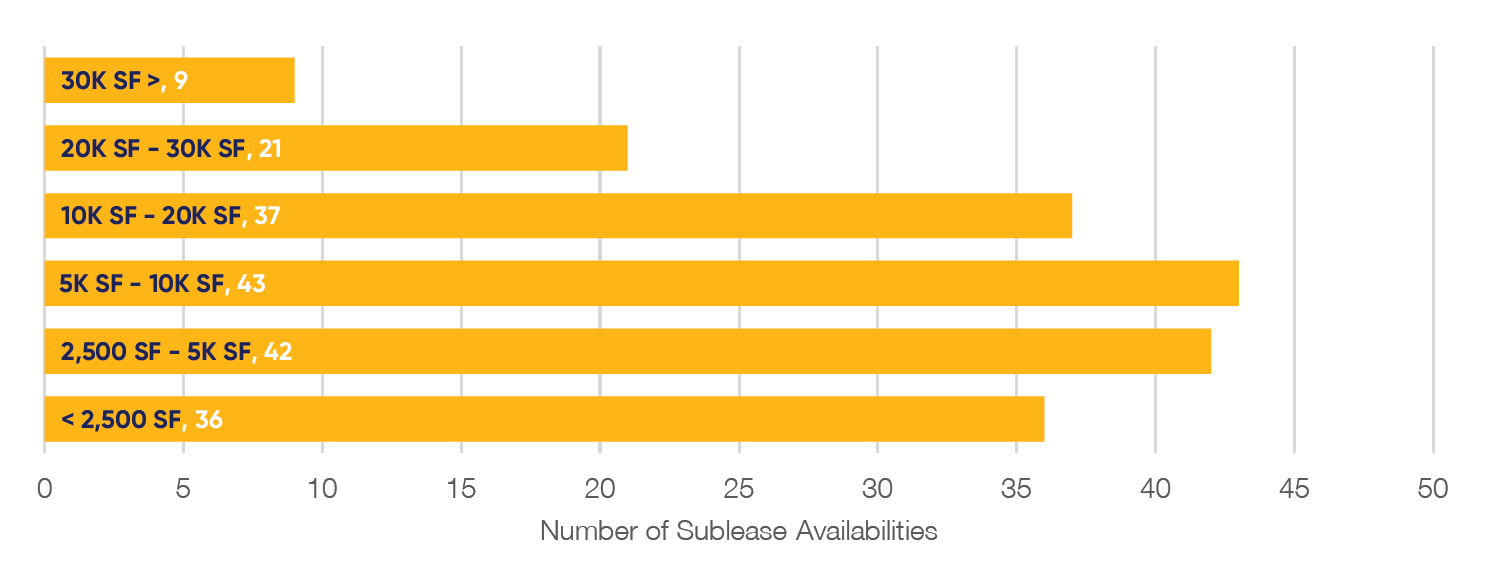

The sublease market in Suburban Maryland continues to play a significant role in the overall office market landscape. There are approximately 188 sublease spaces available in Suburban Maryland, consisting of nearly 1.9 million square feet. Roughly 65% of the available subleases range between 2,500 and 20,000 square feet, offering a diverse range of options for tenants seeking flexibility in their space requirements. The Bethesda and Rockville submarkets dominate the sublease market, accounting for 66% of the total available sublease space.

Pricing for sublease spaces varies, with 77% of the current offerings with listed asking rates set between $15.00 and $35.00 per square foot. The majority of subleases in the market are priced at a significant discount compared to direct spaces, putting further pressure on landlords as they compete for tenants in the market.

Significant activity occurred in the Silver Spring submarket in the fourth quarter, where the market saw four new sublease spaces totaling over 30,000 square feet. Overall, the sublease market experienced a net contraction of 73,000 square feet in the fourth quarter, reflecting slower absorption and ongoing pressure on the market.

Currently, the average time on market for sublease spaces in Suburban Maryland is 24 months, underscoring the competition tenants face in subleasing their space.

Quarterly Change in Sublease Availability

Distribution of Sublease Availabilities by SF

Economic Outlook

The Suburban Maryland office market, which includes the Silver Spring-Frederick-Rockville metropolitan area, recorded an unemployment rate of 2.9% through the fourth quarter of 2024. These figures align closely with pre-pandemic levels, reflecting a robust recovery in the local labor market.

Nationally, the USA’s unemployment rate of 4.1% similarly falls below its 10-year average of 4.7%. While this signals economic stability, inflation remains a concern, with DC’s 12-month CPI change at 2.7%. With costs of goods higher, compounded by elevated labor and construction costs, companies are more prone to make cost-conscious decisions as it relates to their real estate needs.

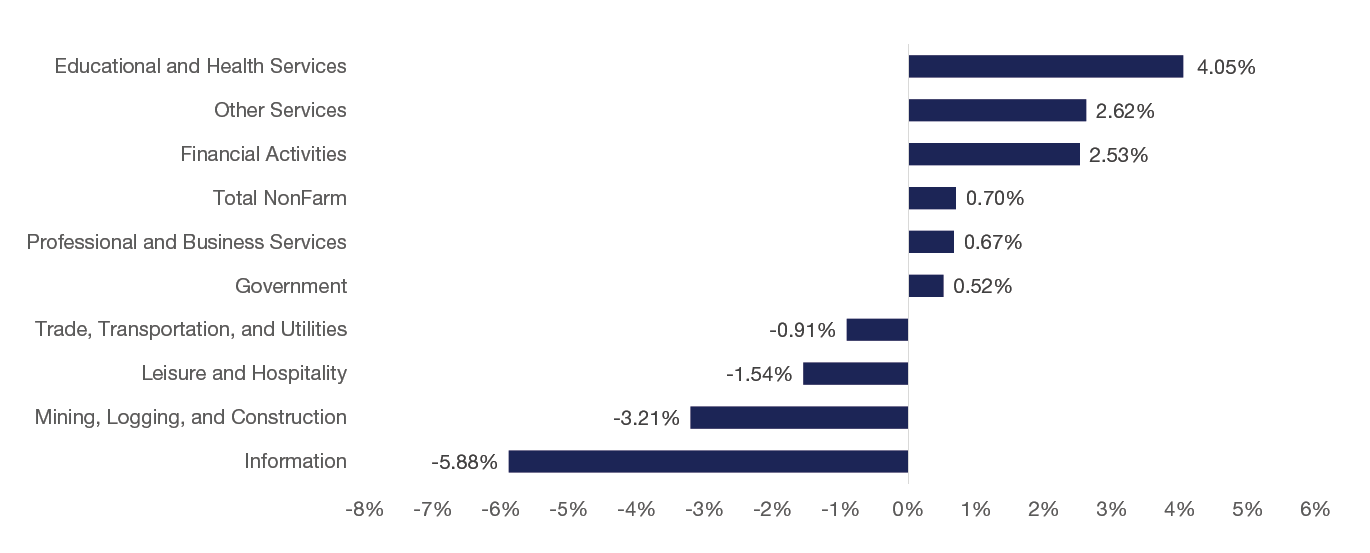

Over the past year, sectors such as Educational and Health Services, Financial Activities, and Other Services have exhibited substantial job growth, contributing to a modest yet steady 0.70% rise in overall nonfarm employment across the region. Between July and September 2024, Educational Services alone added 2,800 jobs, while Health Care and Social Assistance saw continued hiring gains with an additional 1,600 jobs. This contributed to the 4.05% increase in the Educational and Health services labor force compared to the previous year, contributing positively to office space demand, particularly in Montgomery County.

Conversely, declines in sectors like Mining, Logging, and Construction reflect the impact of economic headwinds, with construction activity at historic lows amid reduced demand for new projects. Rising costs and market volatility continue to suppress growth in these areas, signaling broader shifts within the regional labor market as service-sector expansion contrasts with a slowdown in industrial activities.

Unemployment Rate

Consumer Price Index, 12-Month % Change

Employment Growth by Industry, 12-Month % Change, October 2024

Download the full report to learn more.