The Truth About Downsizing: Office Space Still Matters

Downsizing. It's the hottest topic in business. Everyone is talking about it, and we are being led to believe that everyone is doing it. While it's true companies post pandemic are reevaluating their workspaces in a world that is now amenable to remote work, the marketplace chatter is a bit misleading, and definitely not that simple. We decided to take a look at what is really happening in the San Francisco office market and the results may surprise you.

It's true. Companies are evaluating their space needs and attempting to shed excess real estate through subleasing. Driven largely by cost-cutting, some organizations are making do with space they can squeeze into and unloading the rest. Other organizations, however, are forced to make longer term, more thoughtful decisions due to a looming lease expirations and, after planning and budgeting, venture into the market. So, what does current tenant activity in the market tell us about what organizations actually need in terms of office space versus what they have today?

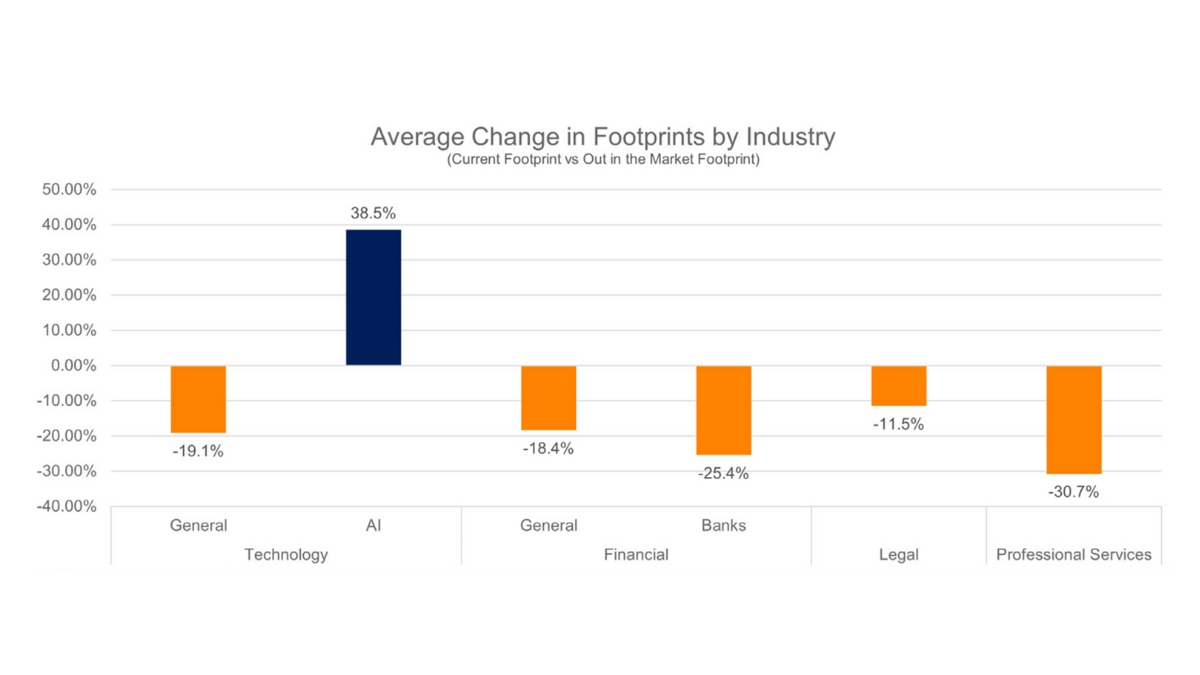

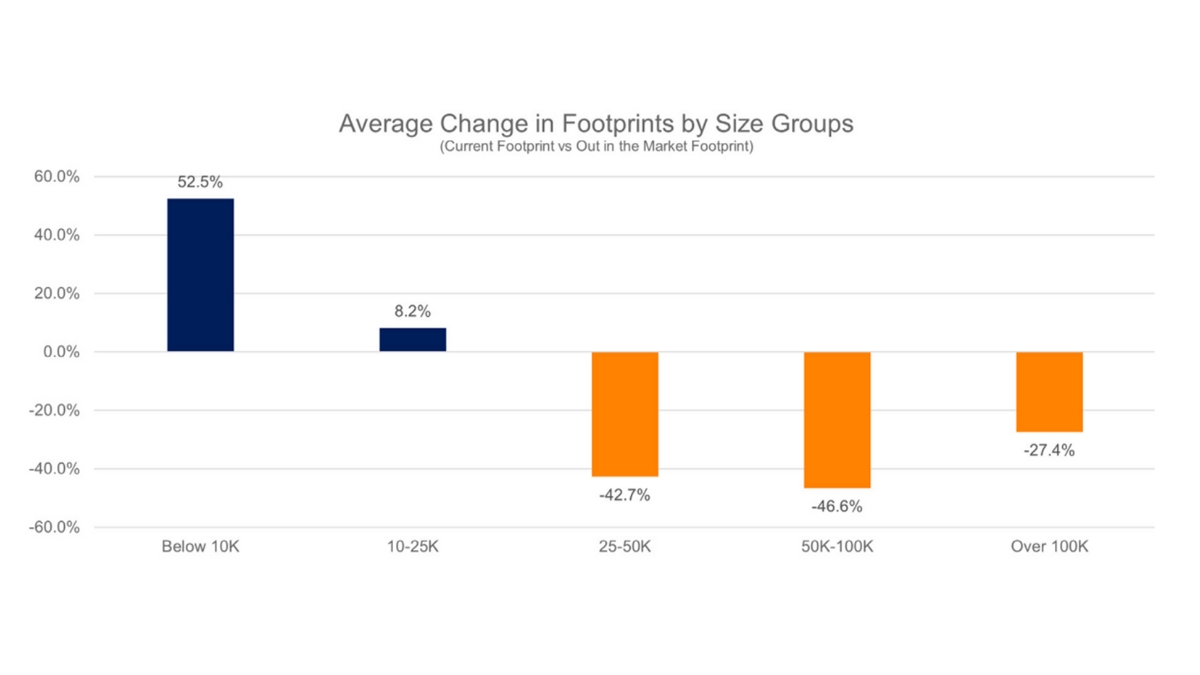

There is a great deal of anecdotal information about downsizing, so Cresa decided to take a look at tenants' needs as demonstrated by their search for space compared to what they are leaving behind. We looked at 137 market requirements (i.e. Tenants in the Market or TIM's) reflecting 3.88 million square feet of demand. The takeaway is that this sample set is in the market for only 3.04 million square feet or a 21.7 percent decrease. The analysis does not stop there, however, as different industries are not necessarily reducing their footprints as aggressively. Focusing on San Francisco tenants only, this is what we learned using the midpoint of each demand range as compared to current footprints:

- Tenants over 100K SF plan to contract by an average of 27.4%

- Tenants between 50K and 100K SF plan to contract by an average of 46.6%

- Tenants between 25K and 50K SF plan to contract by an average of 42.7%

- Tenants between 10K and 25K SF plan to grow by an average of 8.2%

- Tenants below 10K SF plan to grow by an average of 52.5%

A more nuanced review shows that tenants occupying less than 10,000 square feet skew the results for those under 25,000 square feet since they plan to grow by 52.5 percent. These small companies outnumber those closer to 25,000 square feet and tend to have more remote workers, or occupy coworking spaces, and are looking for more permanent solutions to house their workers. If the size cutoff is expanded to 10,000 - 25,000 square feet for all industries, then the demand is on average 8.2 percent more than what they currently occupy. Therefore, the smallest tenants appear to be the most optimistic about growth.

What happens if we drill down by industry?

When looking at the market as a whole, including industries like banking, finance, technology and law that are typically the largest users of space, you find that almost all sectors are shrinking their office footprints with two exceptions: AI which continues to actively seek space, and more of it than the rest of its tech counterparts, and law firm tenants, which are only modestly reducing their footprints relative to the market. Below is a breakdown by sector:

Is anyone growing out there?

The short answer is yes. As illustrated below, companies occupying less than 10,000 square feet have space requirements that tend to be 52.5 percent more than what they currently occupy. Companies from 10,000 - 25,000 square feet want 8.2 percent more than what they currently occupy. And who are these tenants? Start-ups, many of which are in the AI space, are growing by approximately 38.5 percent. AI companies comprise some of the larger requirements. Interestingly OpenAI's current requirement of 100,000 square feet is a 23.1 percent decrease from its current footprint of 130,000 square feet. This is a departure - likely at an earlier stage - from the many other AI companies that appear to be growing.

Tech tenants, which currently occupy less than 10,000 square feet are, on average, expanding their footprints by nearly double or 96.1 percent. Similarly, tech tenants that currently occupy 10,000 - 25,000 square feet are, on average expanding their footprints by just 37.2 percent. So, what does that mean? Companies under 25,000 square feet can still justify growth in their physical footprints, albeit much less so than the 10,000 square feet and under group. But once you look at companies with 25,000 square feet or more, there is a dramatic shift in office space needs. Statistics show that those with 25,000 square feet need an extremely compelling offer and/or justification to take more space.

These statistics are not meant to be a substitute for proper workplace strategy and planning. However, what this tells us is that companies of a certain size or stage of maturity are, for the most part, trending together when it comes to decisions about space utilization.

By: Craig Zodikoff and Andrew McShea

View recent news coverage of this report here.