North American CRE Sentiment Index Q3 2023

North American CRE Sentiment Index

The CRE Sentiment Index is an effort to understand the change in perspectives of corporate real estate professionals on the state of the industry and the impact on their company’s real estate portfolios and alignment with the direction of the business. This effort has been an ongoing campaign in partnership with Knight Frank, our global partner.

This past quarter Cresa made an initial push to provide a more detailed focus on North American-based companies. Thanks to the support of our clients and other CRE professionals, we received nearly 100 responses from professionals working in this increasingly complex and fast-moving environment. As we move forward, the information we collected in our initial effort will serve as a baseline to provide insight into the sentiment of the industry and allow companies to better understand trends and make better-informed decisions.

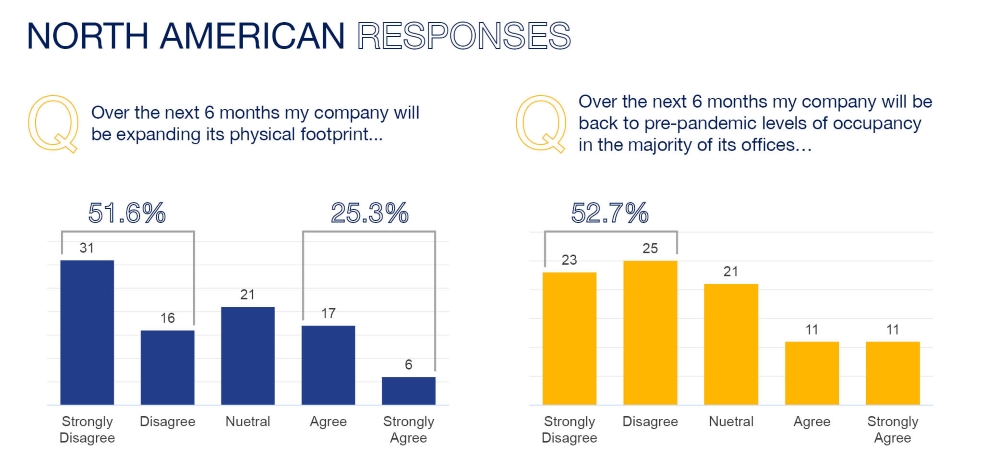

North American Responses

The CRE Sentiment Index is forward-looking with the questions asking what to expect in the next six months. It is segmented into three categories: 1) Growth Dynamic; 2) Portfolio Dynamic; and 3) Workplace Dynamic.

- The Growth Dynamic provides insight into the sentiment for the overall health of the business and planned change in global economic growth, revenue, headcount, and capital expenditures. The respondents were generally neutral to positive in this category, with a positive outlook in company revenue growth over the coming months.

- The Portfolio Dynamic asks questions related to the expected change in CRE portfolios, including physical footprint, relocation, sustainability, and offshoring. Respondents were generally negative in this category, particularly about offshoring, while responded in a neutral position relating to expanding physical footprints.

- The Workplace Dynamic explores respondents forward-looking sentiment to occupancy levels, office design, occupancy density, and amenities. Respondents were generally neutral to slightly positive about the workplace, indicating slightly elevated sentiment in the next six months surrounding increased occupancy levels.

More than half of North American respondents believed their company would not be expanding its physical footprint in the next six months.

Additionally, more than half of North American respondents believe their company will not be back to pre-pandemic occupancy levels in the next six months. Meanwhile, less than 25 percent of respondents believe occupancy will be back to pre-pandemic levels in the next six months.

Methodology

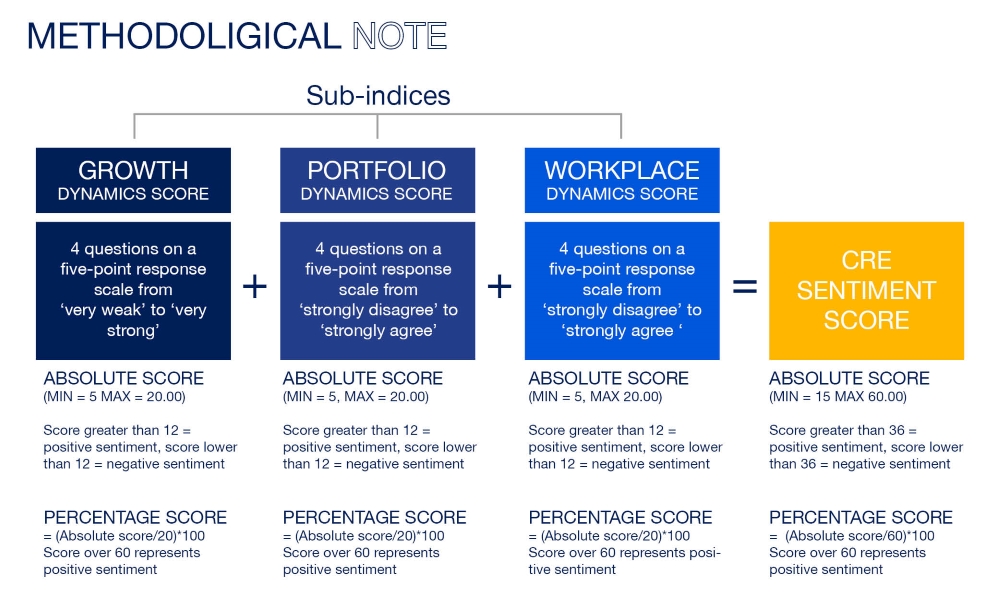

A simple online survey of 12 questions grouped into three equally weighted sub-indices assessing growth dynamics, portfolio dynamics, and workplace dynamics.

Each sub-index comprises four statements that survey respondents place on a five-point response scale, with a score of one indicating strong negative sentiment and a score of five indicating strong positive sentiment. A score of three represents neutral sentiment.

The survey is based on sentiment relating to the next six months from the point of the survey.

Responses to each of the four statements at the sub-index level are aggregated across the sample and averaged. These averages are then added together to provide a sub-index sentiment measure, to a maximum absolute score of 20. A score of greater than 12 indicates positive sentiment and less than 12 represents negative sentiment. Each cohort sentiment measure is also converted to a percentage score, with a score above 60 percent representing positive sentiment.

Each of the three sub-index sentiment measures is then added together to provide an overall absolute CRE Sentiment Score, to a maximum of 60 where a score greater than 36 indicates positive sentiment. Again, this overall score is also converted into a percentage value, with a score above 60 percent representing positive sentiment.

Download the Global CRE Sentiment Index for a broader look at the perspectives of occupiers around the world.