Q4 2024 Northern Virginia Market Report

For additional statistics, download the full report

Market Overview

The Northern Virginia office market continued to face significant challenges throughout 2024. Despite positive net absorption of 351,420 square feet in the fourth quarter—the first quarter of positive absorption since Q1 2022—the year-to-date total ended at negative 2.25M square feet of net absorption. While this is an improvement over the negative 2.85M square feet recorded in 2023, lack of organic tenant demand and entrenched hybrid work policies continue to hamper the leasing market and occupancy rates. Overall rental rates across the market increased slightly to $37.65/SF, representing a 2.4% increase year-over-year. However, rental rates in Class B buildings remain well below the overall average at $30.54/SF. As a possible indicator of the type of tenant demand in Northern Virginia, Class B properties have fared better from an occupancy standpoint, with the asset type’s vacancy rate at 15.4%, representing a 7.8% difference compared to the broader market.

In one of the quarter’s largest transactions, SAIC renewed their lease at 4801 Stonecroft Blvd for 241,000 square feet in the Route 28 South submarket. In the sales market, Brandywine Realty Trust sold the Liberty Center located at 4040 Wilson Boulevard, a 225K square foot Class A building in the Ballston submarket, to Shooshan for $37.33 million ($332.25/SF). Additionally, Walton Street Capital LLC sold three Class A office buildings in the Reston/Herndon submarket—13461 Sunrise Valley Dr, 13655 Dulles Technology Dr, and 13665 Dulles Technology Dr—to Nuveen for $59 million ($171.02/SF). This portfolio sale reflects the ongoing trend of more competitive pricing in the market, with several buildings trading well below previous valuations.

Quarterly Key Performance Indicators

- Net Absorption: 351,420 SF

- Direct Asking Rent: $37.65/SF

- Vacancy: 23.24%

Notable Regional Insights

- Northern Virginia leads the U.S. data center market, driving nearly half of capacity growth in four years.

- Recorded positive net absorption for the first time since Q1 2022.

- The GSA plans to shed multiple leases, with the State Department cutting 770,000 SF in DC and Northern Virginia.

Market Data

Occupancy Trends

The Northern Virginia office market saw several notable deliveries in 2024. In November, George Mason University’s College of Business completed a 345,000 square-foot Class A building at 3401 Fairfax Drive in the Virginia Square submarket. This follows recent developments in the District. In May, Skanska delivered a 200,000 square-foot Class A building at 3901 N Fairfax Drive in the Ballston submarket. In June, the Reston submarket also welcomed a significant addition with the completion of a 330,000-square-foot Class A office building at 1800 Reston Plaza Road. Net absorption in Q4 2024 totaled positive 351,000 square feet, marking a sharp turnaround from the deeply negative figures recorded earlier in the year. Year-to-date, net absorption stands at negative 2.25 million square feet, an improvement over the negative 2.86 million square feet reported through Q3 2024. Class A properties led the recovery, contributing 238,000 square feet of positive absorption in Q4, highlighting renewed tenant demand for high-quality office spaces.

Construction Snapshot

Following nearly a decade of active development, the Northern Virginia office market’s development pipeline has sharply leveled off. This slowdown is primarily driven by unpredictable tenant demand, rising construction costs, and broader economic challenges. Amid the ongoing “flight-to-quality” trend in the commercial real estate market, the limited number of new Class A projects could create a ripple effect, potentially tightening this segment of the market for tenants seeking higher-quality spaces. In Q4 2024, only one building—a 345,000-square-foot Class A office space—was delivered, with approximately 765,000 square feet still under development. This represents a dramatic decline compared to the 2019 peak, when over 3.3 million square feet was under construction.

Market Vacancy

The Northern Virginia office market is seeing a clear divide in performance between Class A and Class B properties. As of 2024, Class B buildings maintain a lower average vacancy rate of 15.5%, while Class A properties are struggling with significantly higher vacancies at 26.3%. This disparity has been amplified by recent deliveries in key submarkets like Ballston and Virginia Square, which have added substantial un-leased inventory to the market. A prime example is the newly delivered 345,000-square-foot Class A office building at 3401 Fairfax Drive, which remains 32.5% vacant following its November 2024 completion. Similarly, the 200,576-square-foot Class A office building at 3901 N Fairfax delivered in the third quarter of 2024 and remains 100% vacant following its completion in May 2024. These new additions are contributing significantly to the elevated vacancy rates in Class A spaces, as landlords face the challenge of leasing premium office space in a market where tenant demand remains uncertain.

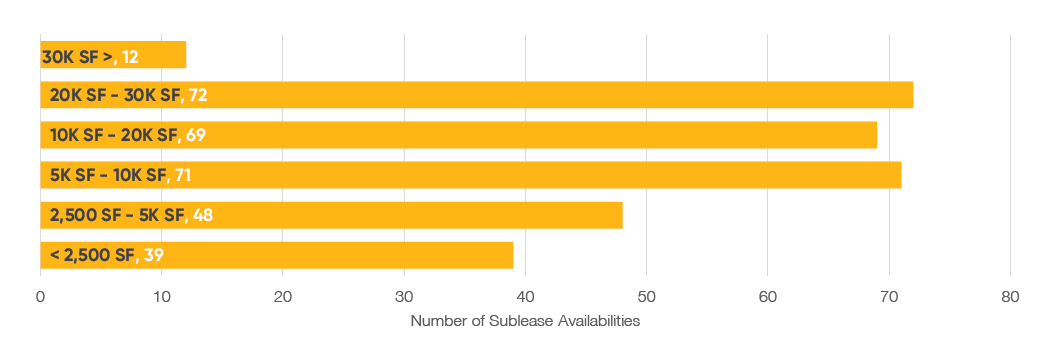

Sublease Report

The sublease market in Northern Virginia continues to play a significant role in the overall office market landscape. As of the fourth quarter of 2024, there are approximately 311 sublease spaces available in Northern Virginia, consisting of 4 million square feet of office space. Roughly 70% of the available subleases range between 5,000 and 30,000 square feet, offering a diverse range of options for tenants seeking flexibility in their space requirements. The Tysons Corner, R-B Corridor, and Reston/Herndon submarkets dominate the sublease market, accounting for 70% of the total available sublease space.

Pricing for sublease spaces varies, with 88% of the current offerings with listed asking rates set between $15.00 and $35.00 per square foot. The majority of subleases in the market are priced at a significant discount compared to direct spaces, putting further pressure on landlords as they compete for tenants in the market.

Significant activity occurred in the Merrifield submarket, where Colliers added two new sublease spaces in December, totaling just under 50,000 square feet at 3180 Fairview Park Drive.

The sublease market did show signs of tightening in 2024, with total sublease inventory across Northern Virginia decreasing by over 560,000 square feet over the past year.

Quarterly Change in Sublease Availability

Distribution of Sublease Availabilities by SF

Economic Outlook

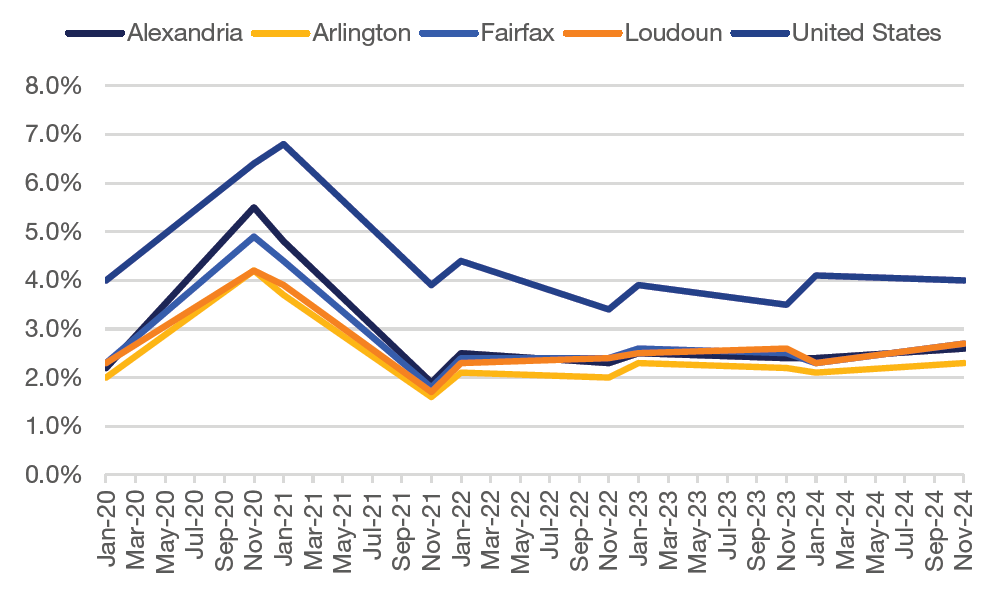

The Northern Virginia office market, which includes Alexandria, Arlington, Fairfax, and Loudoun counties, recorded unemployment rates between 2.3% and 2.7% through the fourth quarter of 2024. These figures align closely with pre-pandemic levels, reflecting a robust recovery in the local labor market.

Nationally, the USA’s unemployment rate of 4.1% similarly falls below its 10-year average of 4.7%. While this signals economic stability, inflation remains a concern, with the DC metro area 12-month CPI change at 2.7%. With costs of goods higher, compounded by elevated labor and construction costs, companies are more prone to make cost-conscious decisions as it relates to their real estate needs.

Unemployment Rate

Consumer Price Index, 12-Month % Change

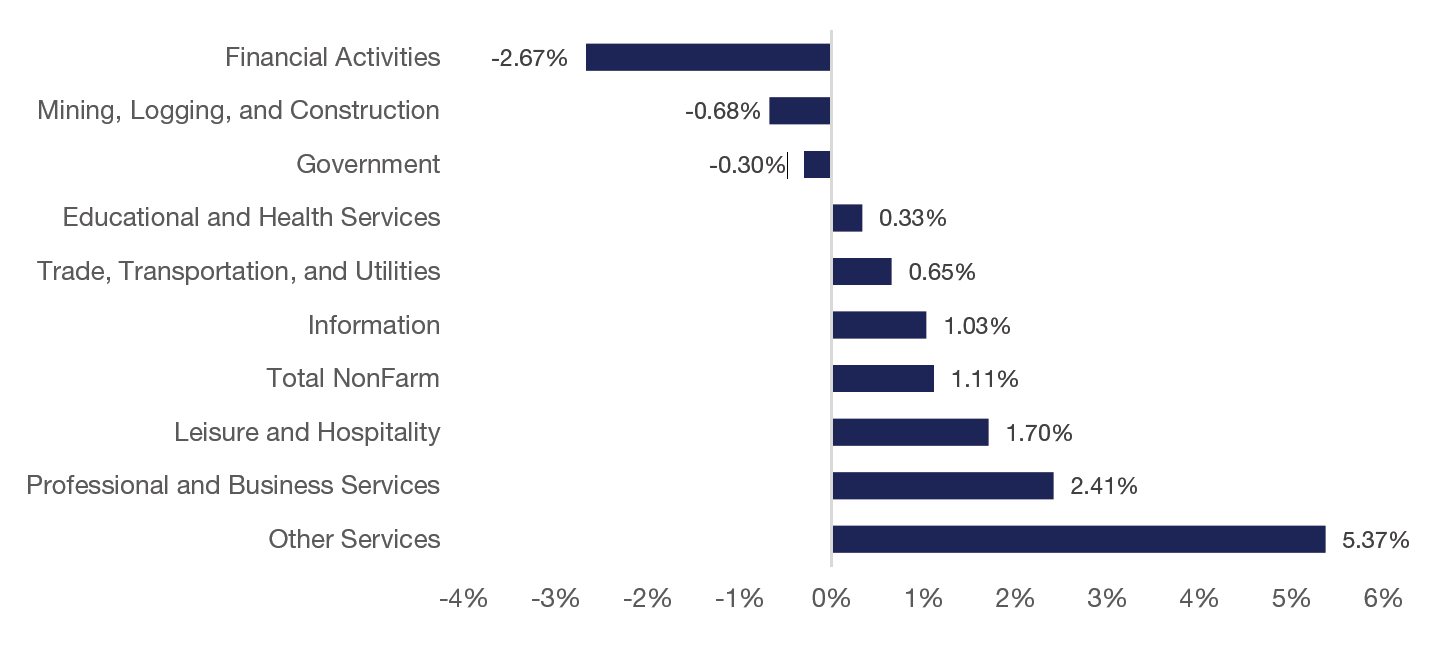

Employment Growth by Industry, 12-Month % Change, October 2024

Download the full report to learn more.