3Q 2019 Houston Office Market

Slow Real Estate Recovery Ensures Market Remains Occupier Friendly

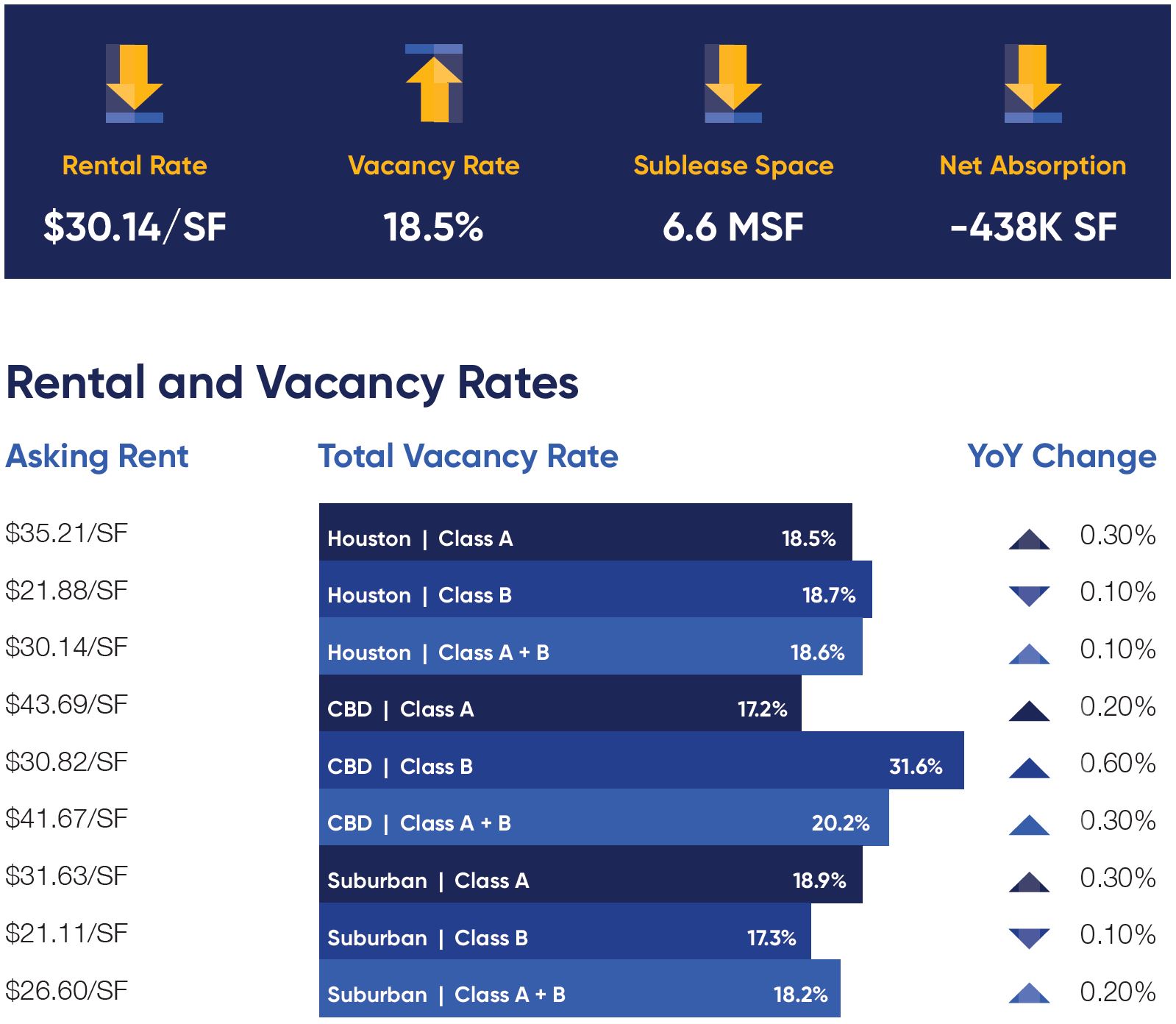

Leasing activity continued to lag below the elevated levels we saw in 2018, further indicating the current tenant-friendly market. As prices for WTI continue to hover in the mid-$50 range, there is potential for continued consolidation in the oil & gas sector pushing large blocks of availability onto the market.

The former ConocoPhillips campus in West Houston was again put up for sale after Occidental decided that it couldn’t house its expanded headcount after acquiring Anadarko earlier in the year. The over 1 MSF campus may not all end up back on the market as office inventory though, as the property is being marketed as a mixed-use redevelopment project.

Net absorption for the quarter was again negative, with -438,941 SF of class A & B direct space vacated across the MSA. Houston’s overall job growth remains strong, however, adding 84,400 new jobs in the 12 months ending in September. Expected continued strong job growth bodes well for the eventual office market recovery once the sublease hangover wears off.