Q2 2025 Northern Virginia Market Report

For additional statistics, download the full report

Market Overview

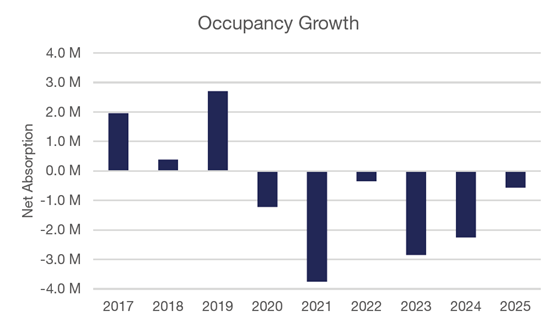

The Northern Virginia office market continued to face significant challenges through the first half of 2025. Following negative net absorption of 286,510 square feet in Q1, the market experienced 279,119 square feet of negative net absorption in Q2, bringing the yearly total to negative 565,629 square feet. This has contributed to continued softening in leasing activity and occupancy rates.

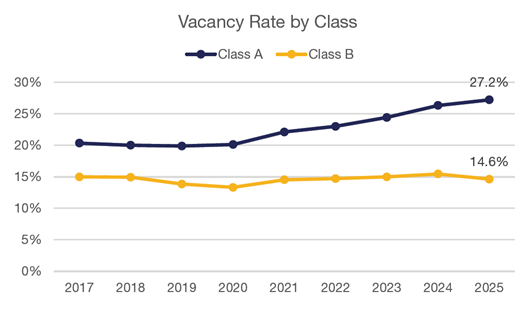

Overall rental rates declined slightly to $36.34/SF, representing a 0.7% decrease quarter-over-quarter but still a 2.7% increase year-over-year. Class A rental rates rose to $39.69/SF, marking a notable 5.1% increase from the previous quarter. Additionally, Class B rents declined to $29.51/SF, reflecting a 1.8% decrease quarter-to-quarter. Vacancy rates remain elevated at 23.1% overall, with Class A vacancy at 27.3%. Class B buildings continue to perform better from an occupancy standpoint, with the asset type’s vacancy rate at 14.5%, an 8.5% difference compared to the broader market and 12.8% when compared to Class A.

One of the largest transactions in Q2 was the Department of Homeland Security’s extension at 4601 N Fairfax Drive in the Ballston, with the agency occupying 76,987 square feet. On the sales side, Peterson Companies sold the 434,000-square-foot Class A office building at 13870 Air and Space Museum Parkway, built in 2010, to the Department of Homeland Security for $246.4 million ($317.78/SF). Additionally, a joint venture formed between Foulger-Pratt and Affinius Capital sold a 388,206-square-foot Class A office building to The Meridian Group for a $104.8 million ($269.85/SF) located at 1750 Tysons Central Street.

Quarterly Key Performance Indicators

- Net Absorption: (279,119) SF

- Direct Asking Rent: $36.34/SF

- Vacancy: 23.05%

Notable Regional Insights

- Northern Virginia saw a dip in net occupancy this quarter, driven by major move-outs and aging office stock — though George Mason University’s 184,940 SF lease at The Fuse helped soften the impact.

- Aerospace & Defense firms continue to anchor demand, making up 25% of leasing activity this quarter, supported by steady contract awards and an expected boost to the Defense budget.

Market Data

Occupancy Trends

Occupancy challenges continue to hamper the Northern Virginia office market, placing sustained downward pressure on the development pipeline. Net absorption in Q2 2025 totaled negative 279,119 square feet, bringing the year-to-date total to negative 565,629 square feet. Class A properties remain the primary source of occupancy losses, contributing 229,150 square feet of negative absorption in Q2—approximately 82% of the quarterly decline—and totaling more than 511,000 square feet in losses year-to-date. Class B product also softened, recording nearly 50,000 square feet of negative absorption this quarter. Although the overall trend remains negative, submarket performance was mixed. Fairfax Center and the I-395 Corridor each posted over 200,000 square feet of negative absorption, reflecting persistent demand weakness. In contrast, Courthouse/Clarendon, Reston, and the Route 28 Corridor South recorded more than 100,000 square feet of positive absorption, signaling localized tenant interest and leasing momentum. Notably, 1880 Reston Row Plaza, a 210,000-square-foot Class A office building developed by Comstock Companies, delivered in April 2025. While this marks a significant addition to the Reston submarket, it was the only major delivery in the first half of the year.

Construction Snapshot

Following nearly a decade of active development, the Northern Virginia office market’s development pipeline has sharply leveled off. This slowdown is primarily driven by unpredictable tenant demand, rising construction costs, new tariffs, and broader economic challenges. Amid the ongoing “flight-to-quality” trend in the commercial real estate market, the limited number of new Class A projects could create a ripple effect, potentially tightening this segment of the market for tenants seeking higher-quality spaces. As of Q2 2025, a total of 486,992 square feet is under construction, which stems from Class A office developments in the I-395 Corridor, Merrifield, and Route 7 Corridor submarkets. This marks a significant decline compared to the 2019 peak, when over 3.3 million square feet was under construction. Notably, one of the larger projects underway is 7125 W Falls Station Boulevard, a 270,000-square-foot Class A building in the Merrifield submarket.

Market Vacancy

The Northern Virginia office market continues to see a clear divide in performance between Class A and Class B properties. As of Q2 2025, Class B buildings maintain a lower average vacancy rate of 14.5%, while Class A properties are facing significantly higher vacancy at 27.3%.In the Ballston submarket, Class A buildings along North Fairfax Drive—ten properties in total—are collectively 46.2% vacant. A notable contributor is the 200,576-square-foot Class A office building at 3901 N Fairfax Drive, delivered in 2024, which remains 82.7% vacant. These large blocks of unleased space are contributing significantly to elevated vacancy rates in the Class A segment, where landlords continue to face challenges securing tenants amid ongoing uncertainty in demand.

Sublease Report

The sublease market in Northern Virginia continues to play a significant role in the overall office landscape. As of Q2 2025, there are approximately 310 sublease spaces available across the region, totaling around 4 million square feet of office space. Roughly 66% of these available subleases fall between 5,000 and 30,000 square feet, offering a range of flexible options for tenants. The Tysons Corner, R-B Corridor, and Reston/Herndon submarkets continue to dominate the sublease market, collectively accounting for 77% of the region’s total sublease inventory.

Sublease pricing remains competitive, with 44% of current offerings asking between $15.00 and $35.00 per square foot. Most sublease listings continue to be priced below direct market rates, placing additional pressure on landlords competing for tenants.

Significant activity occurred in the Tysons submarket, where ten new sublease spaces totaling approximately 60,000 square feet were added. The Rosslyn submarket also saw increased activity, with five new sublease spaces totaling approximately 70,000 square feet added to the market in the second quarter. The sublease market continues to tighten following a noticeable decline in inventory over the past year.

Quarterly Change in Sublease Availability

Distribution of Sublease Availabilities by SF

Economic Outlook

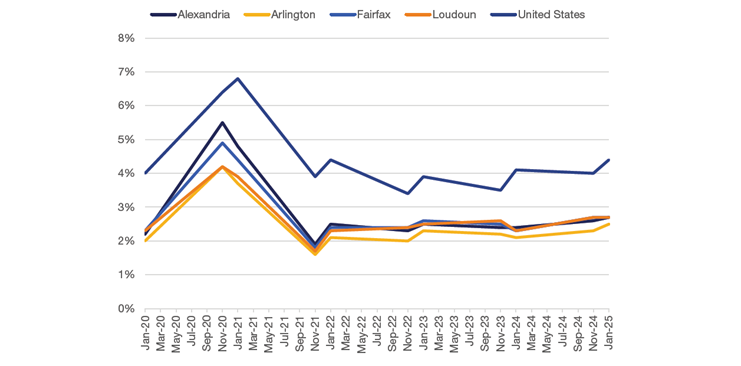

The Northern Virginia office market, which includes Alexandria, Arlington, Fairfax, and Loudoun County, recorded unemployment rates between 2.5% and 2.7% through the second quarter of 2025. These figures align closely with pre-pandemic levels, reflecting a robust recovery in the local labor market.

On a national scale, the U.S. unemployment rate stands at 4.4%, slightly below the 10-year average of 4.7%, indicating overall economic stability. However, inflation remains a persistent concern, with the Washington, DC metro area experiencing a 12-month CPI increase of 1.9%. As the cost of goods continues to rise, compounded by elevated labor and construction costs, companies are becoming more cost-conscious in their real estate decisions. This cautious approach is impacting leasing activity, as firms prioritize efficiency and value in their office space commitments amid these economic pressures.

Unemployment Rate by Selected Counties

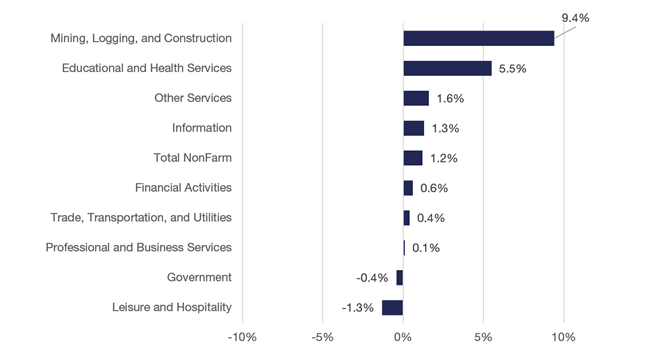

Employment Growth by Industry 12-Month % Change May 2025

Download the full report to learn more.