Q3 2022 - Portland Office Market Report

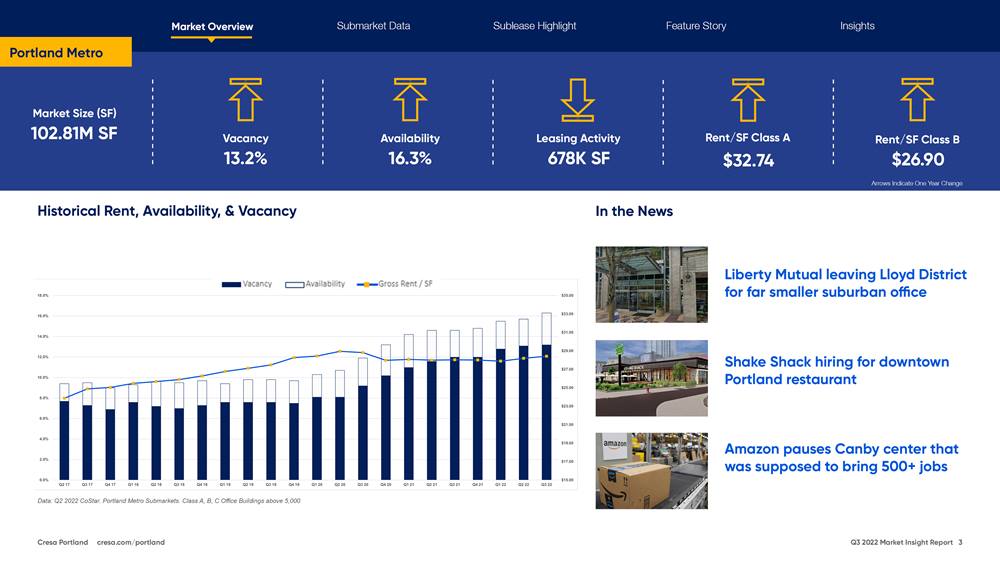

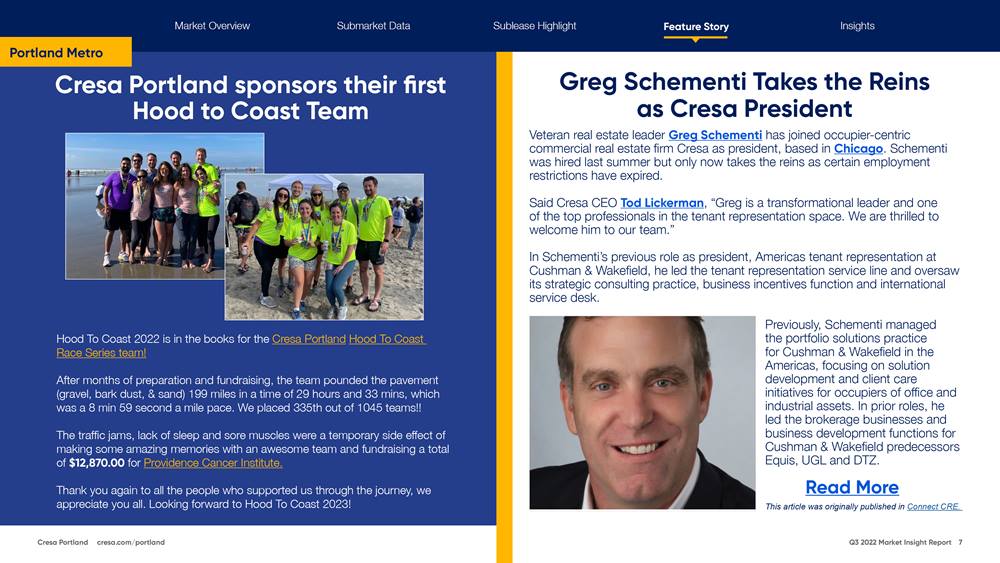

While the Portland metro is still trying to claw its way out of the doldrums of the pandemic, we’re now being hit with economic headwinds of inflation, lack of market demands, and continued uncertainty plaguing the 3rd quarter. Amidst the direct vacancy that continues to climb, nearly every technology company in the downtown core is either a) subleasing their space or b) attempting to negotiate early lease buyouts. In a city that was on a tremendous growth trajectory for tech, we’re now reeling from the golden days of a couple years past. Nearly all companies from AirBnB, Puppet, Vacasa, Momentive, New Relic, to startups, among many, many others are a now a physical shell of what they once were in a vibrant ecosystem. Another recent tech announcement was the sale of Brainium, which was a bright spot during Covid, where they took a full floor at Tanner Point. We will be watching what happens there. Beyond tech, we continually monitor the general office market activity; who’s moving, staying, rightsizing, closing, expanding, etc. and the overall health of the metro.